Tesla Stock Analysis: Why the Recent Dip Could Be a Good Sign for Investors

Tesla Stock Update: A Volatile December 2024

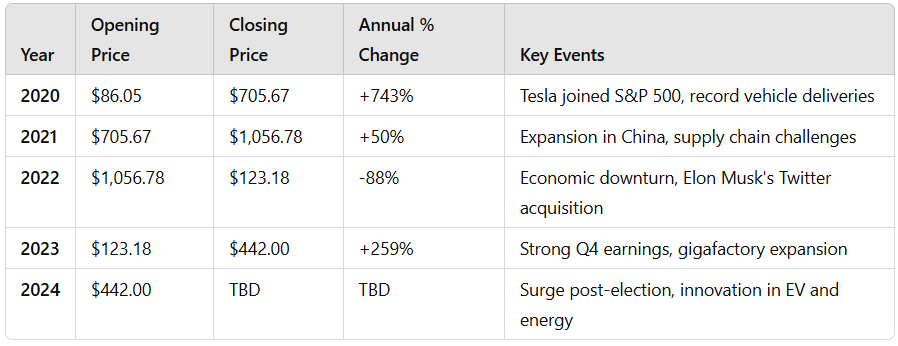

Tesla Inc. (TSLA) experienced a sharp decline today, with its stock dropping 8.28% to close at $440.13. This dip follows a massive 91% surge in the wake of the U.S. presidential election, which added $735 billion to Tesla’s market value.

Tesla Stock While the recent downturn is concerning, many analysts remain bullish on Tesla’s long-term prospects. Baird analyst Ben Kallo has raised his price target from $280 to $480, citing Tesla’s strong position in the electric vehicle market and its growth potential in renewable energy.

The broader Tesla Stock market’s concerns over interest rates and the Federal Reserve’s policy have contributed to this volatility. However, for some investors, today’s pullback may present a buying opportunity.

Looking ahead, Tesla’s stock will likely continue to be influenced by broader economic trends, including interest rate decisions, as well as the company’s ongoing innovations in EVs and energy storage. Despite the volatility, Tesla remains a leader in the EV and clean energy sectors, making it a stock to watch in 2024.

Read More :-

AI in Everyday Life: The Revolutionary Impact of Tools Like ChatGPT 2025

10 Surprising Ways AI Is Transforming Your Daily Routine

How Character AI is Transforming Movies, Games, and Entertainment

Post Comment